Estate Planning Considerations by Net Worth

June 2024

Disclaimer: As financial planners and wealth advisors, we want to emphasize that while we can provide guidance, we are not attorneys. Before taking action, we strongly recommend consulting with an estate planning attorney.

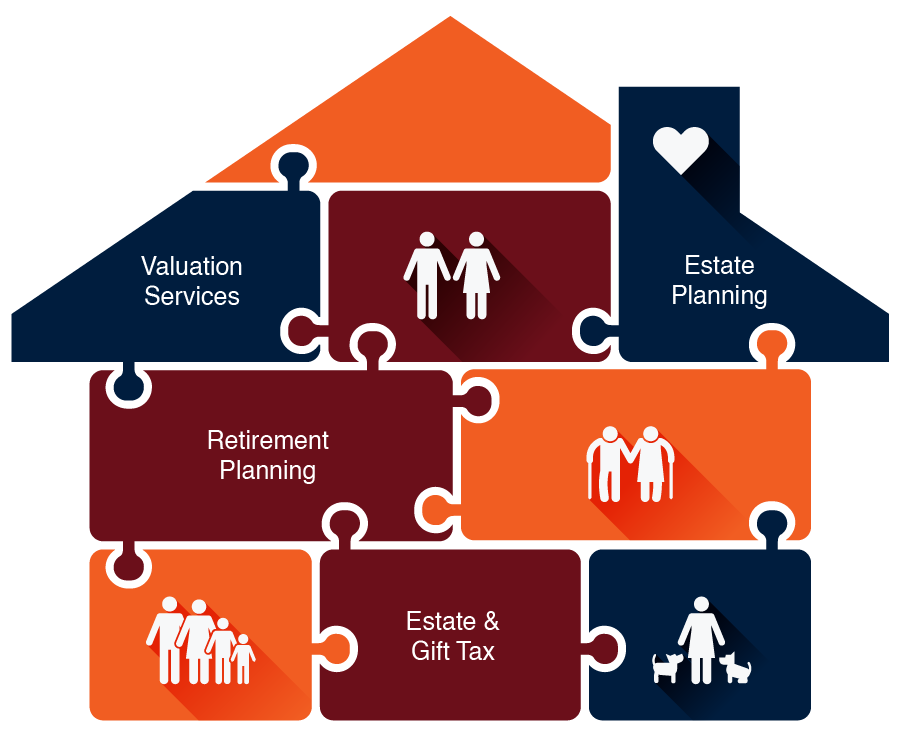

In both financial planning and estate planning, it is essential to have a strong foundation before diving into complex strategies. Continue reading below as we discuss the key financial planning factors you should consider during the estate planning process.

Key Financial Planning Considerations

Retirement Planning

During this stage of life, people often ask, “What am I going to do with my newfound free time?” Though retirement planning is different than other standard financial planning topics, it is arguably the most important. For many business owners and working professionals, you live a busy life for decades and are expected to shut it off one day. Our team of advisors have found that those who are mentally, physically, and often spiritually active, enjoy retirement and find the most fulfillment.

Staying active in retirement is of utmost importance and our experience shows that those who have a proper retirement plan in place and have spent the time thinking through their plan, find the most success at this stage. Do not wait until retirement to discover what you enjoy outside of your current work.

Distribution Planning

When it comes to deciding where to withdraw your retirement fund from, it is often recommended to tap into taxable assets early in retirement to help manage your taxes through smart trading practices. While pensions are not as prevalent as they once were, they provide a great source of guaranteed income, allowing other accounts to continue growing.

Income from alternative investments or rental properties can play a significant role in sustaining your retirement lifestyle. By incorporating all income sources into a well-thought-out distribution plan, you will ensure a smooth transition into retirement.

The decision of when to claim Social Security benefits is often a personal decision. Our team can help advise, enabling clients to make informed decisions.

As for Required Minimum Distributions, they are mandatory withdrawals from 401(k) and IRA accounts. Once you reach the age of 73, you are required to start distributing a portion of those accounts. While there may be exceptions, this rule generally applies to most individuals.

Tax Planning

An essential part of retirement tax planning is strategizing which accounts to draw from and navigating how to unwind your qualified assets. This is where smart distribution planning plays a vital role.

Early in retirement, consider utilizing brokerage and trust accounts to meet income needs. While many focus on maximizing deductions during their working years, there is a significant opportunity to take advantage of those lower-income years in retirement prior to Social Security (SS) and Required Minimum Distributions (RMDs) kicking in. Roth Conversions help reduce future RMDs, creating a valuable asset later in life or the next generation.

During the years between retirement and SS/ RMDs, the focus often shifts toward keeping taxes low through smart trading, implementing Roth Conversions, and managing fund distributions wisely to meet your monthly needs.

Debt Strategies

The approach to debt strategies depends on the characteristics of the debt. For instance, if you have a mortgage with a low-interest rate, there may not be an incentive to pay it off. On the other hand, if you’re dealing with credit card or personal debt with a higher interest rate, it often makes sense to prioritize paying this off sooner rather than later. Ultimately, it’s important to consider what the debt is for and if it’s tied to an asset to help determine the most effective debt strategy for your financial situation.

Plans for Existing and Future Real Estate Purchases

At this stage of life, many clients often buy and sell properties. When it comes to purchasing a new property, the conversation normally revolves around how to finance it. There are many options that we can explore, such as utilizing funds from accounts, lines of credit, margin, or cash on hand. Each option offers a unique opportunity to tailor the financial strategy to best suit the individual client’s needs and goals.

The need for comprehensive risk management increases as your balance sheet and financial life grows in complexity. For example, if you own properties in multiple states and each is managed by different agents, now is the time to consult with a broker. Contact our team of advisors to help you get in touch with the right professionals.

Healthcare & Insurance

Navigating the Pre-Medicare health insurance plan is one of the biggest challenges for those retiring before 65. Depending on your situation, you have a few options, but for most individuals, utilizing the marketplace is a failsafe option to provide coverage in the event of a catastrophe. There are a few other options depending on the assets your own and how they are structured. Some clients create their own health insurance plan for a husband and wife, through an LLC.

As you near 65 and are approaching the Medicare Plan, you will start to receive an overwhelming amount of information. Having a guide to help you through the enrollment process is crucial. If you’re unsure of where to start, reach out to our team of advisors to help you navigate the conversations.

Gifting

Donor Advised Funds are a great way to consolidate donations during high tax years. When coupled with donating appreciated securities you receive two tax benefits, while donating to your favorite charity.

Cash donations are often the easiest for those making the donation but are not the most tax-advantaged way of making donations. There are Adjusted Gross Income (AGI) limits ranging from 30% to 60% depending on the organization receiving the donation. When gifting to children and relatives, you can give up to $18,000 per person without being subject to the federal gift tax.

529 and Education Planning, utilizing the gifting limit above of $18,000 per person in 2024, clients can fund or even super-fund 529s for grandchildren. The same principle can be applied to education funding through brokerage accounts.1

Estate Planning Considerations Based Upon Net Worth

For those with significant assets, it is crucial to consider more complex strategies such as setting up trusts or creating a comprehensive estate plan to minimize tax liabilities and ensure a smooth transfer of wealth to future generations. See below for estate planning considerations based upon net worth.

$0-10mm Net Worth Estate Planning Documents

- Last Wills and Testaments

- Revocable Living Trust

- Probate Avoidance

- Protection Against Incapacity

- Asset Protection

- Estate Tax Benefits for Future Generations

- Financial Powers of Attorney

- Medical Powers of Attorney

- HIPAA Authorizations

- Declarations of Guardians and Declarations of Guardians for Minor Children (if applicable).

- Directives to Physicians

$10mm-$27mm Net Worth Estate Planning

Everything listed above is considered foundational and still applies. These are in addition.

- Annual Gifting of $18,000 or $36,000 for a married couple. This can be given to an infinite number of people and does not reduce your lifetime gift and estate tax exemption amount.

- Things to consider, with the current exemption amount is $13,610,000 per spouse, this reduces the need for advanced estate planning for many that have net worths in this range.

- As you near the lifetime exemption, depending on the makeup of your assets and their growth profile, the need for estate planning changes.

- This is subject to significantly change in 2026 unless the Tax Cuts and Jobs Act is extended, with the lifetime exemption being cut in half.

- The next two years are a great time if you find yourself in this area to do estate planning and take advantage of these very high exemptions.

$27mm and Above Net Worth Estate Planning

Everything listed above and plus the following should be considered.

- Spousal Lifetime Access Trust (SLATs)

- Irrevocable Life Insurance Trust (ILIT)

- Family Limited Partnership (FLP)

- Grantor Retained Annuity Trusts (GRAT)

- Intentionally Defective Grantor Trust (IDGTs)

- At this level of net worth there are countless tools at your disposal to squeeze and freeze assets, these are just a few of the most common methods.

Estate Planning Considerations Based Upon Net Worth

For those with significant assets, it is crucial to consider more complex strategies such as setting up trusts or creating a comprehensive estate plan to minimize tax liabilities and ensure a smooth transfer of wealth to future generations. See below for estate planning considerations based upon net worth.

$0-10mm Net Worth Estate Planning Documents

- Last Wills and Testaments

- Revocable Living Trust

- Probate Avoidance

- Protection Against Incapacity

- Asset Protection

- Estate Tax Benefits for Future Generations

- Financial Powers of Attorney

- Medical Powers of Attorney

- HIPAA Authorizations

- Declarations of Guardians and Declarations of Guardians for Minor Children (if applicable).

- Directives to Physicians

$10mm-$27mm Net Worth Estate Planning

Everything listed above is considered foundational and still applies. These are in addition.

- Annual Gifting of $18,000 or $36,000 for a married couple. This can be given to an infinite number of people and does not reduce your lifetime gift and estate tax exemption amount.

- Things to consider, with the current exemption amount is $13,610,000 per spouse, this reduces the need for advanced estate planning for many that have net worths in this range.

- As you near the lifetime exemption, depending on the makeup of your assets and their growth profile, the need for estate planning changes.

- This is subject to significantly change in 2026 unless the Tax Cuts and Jobs Act is extended, with the lifetime exemption being cut in half.

- The next two years are a great time if you find yourself in this area to do estate planning and take advantage of these very high exemptions.

$27mm and Above Net Worth Estate Planning

Everything listed above and plus the following should be considered.

- Spousal Lifetime Access Trust (SLATs)

- Irrevocable Life Insurance Trust (ILIT)

- Family Limited Partnership (FLP)

- Grantor Retained Annuity Trusts (GRAT)

- Intentionally Defective Grantor Trust (IDGTs)

- At this level of net worth there are countless tools at your disposal to squeeze and freeze assets, these are just a few of the most common methods.