Navigating the Future of Family Wealth:

Retirement Planning Strategies

June 2024

By Tyler Ayres, WPWealth Manager

Disclaimer: This insight is designed only to provide general information regarding its subject matter and should not be construed as tax, accounting, or legal advice to any specific person or entity. The statutes, authority, or other law discussed or cited in the insight are subject to change and Whitley Penn assumes no obligation to update the reader of any changes. Any advice or opinion regarding the application of the subject matter for a specific person or entity should be provided by a competent professional tax advisor based on the application of the appropriate law and authority to the facts and circumstances applicable to that person or entity.

Every year, adventurers are drawn to Mount Everest, eager to conquer its majestic heights. Surprisingly, many climbers attest that the most challenging part isn’t the ascent, but the descent. Similarly, in retirement planning, the journey isn’t just about accumulating wealth – it’s about safely navigating the downward slope, to ensure the preservation and longevity of your financial legacy for future generations.

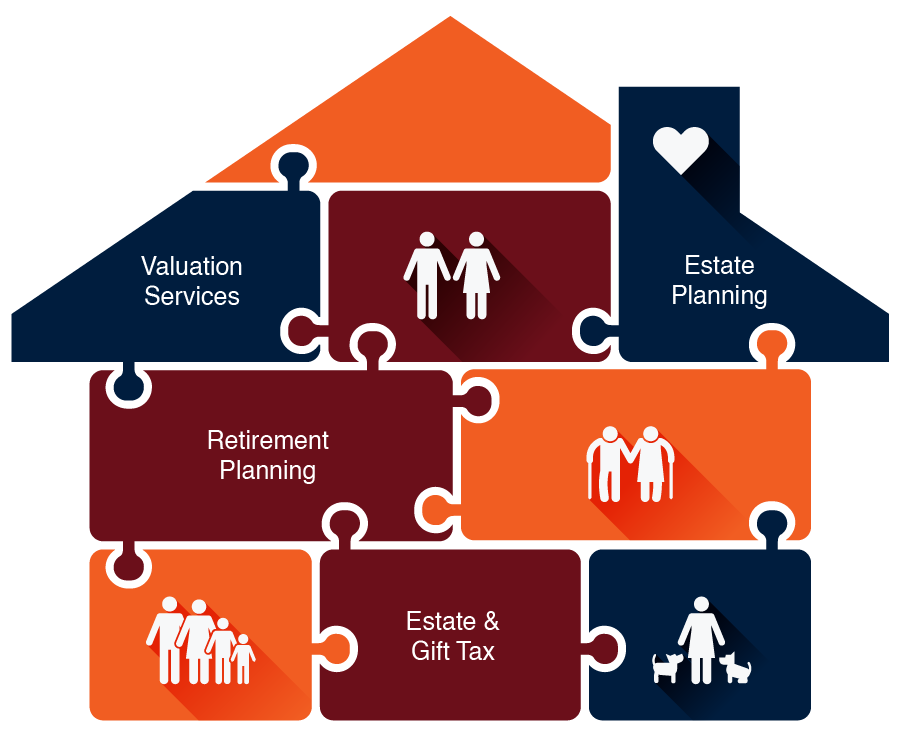

Retirement planning involves a myriad of decisions, from timing job exits to maximizing social security benefits, and crafting efficient distribution strategies. Thoughtful retirement planning strategies revolve around three key pillars: asset preservation and growth, tax planning, and distribution planning.

Preserving assets is paramount, particularly as retirees seek to maintain growth while safeguarding against market volatility. For instance, if we take two retires with the same age, expenses, goals, and assets, but one who retired at the start of a down market or mid-way through a bull market, would have substantially different outcomes. This is what is referred to as “Sequence of Return Risk” which is a major retirement risk that can be difficult to mitigate. One of many retirement planning strategies used to minimize this risk may include a thoughtful distribution plan focused on cash flow planning. Understanding a retiree’s monthly cash needs, aligning a portfolio to meet those needs, and still provide enough liquidity and yield is vital for a successful retirement plan.

Moreover, diversifying one’s portfolio for retirement remains a key strategy for wealth preservation. Given their limited investment timelines, retirees cannot risk the gamble on individual asset class investing, let alone stock-picking based on the latest stock hitting the news headlines. Investors with broad diversification may never have the highest returns relative to individual asset classes each year, but on the same token, diversified investors are mitigating the downside risk of their portfolio.

Tax Planning

As individuals approach retirement, they are often in their peak income earning years, leading to potential shifts into higher tax brackets as they enter their first full year of retirement. This provides a great opportunity for 401(k) and IRA deferrals along with catch-up contributions, to reduce taxable income throughout your highest income earning years. As you ease into the early years of retirement – before hitting the Required Minimum Distribution (RMD) threshold – it becomes the opportune moment to start Roth conversion planning. By converting traditional IRA funds to Roth accounts within lower tax brackets, retirees minimize future RMDs, protect their assets from tax erosion, and alleviate tax burdens for their beneficiaries.

Often the subsequent generation receives their inheritance during their prime earning years. With the removal of the stretch-IRA rule (as per Secure Act 1.0 & 2.0), non-spousal beneficiaries (with certain exceptions) are required to distribute IRA assets within 10 years. This requirement introduces additional taxable income into their tax return, potentially leading to significant tax implications.iii This proactive approach empowers the next generation to manage inherited assets efficiently, ensuring a smooth transition of wealth.

Distribution Planning

Crafting a distribution plan is just as essential to maximizing the transfer of wealth to the next generation. Ensuring you have a clear understanding of your income and asset resources is crucial for maintaining financial stability in retirement.

Identifying fixed expenses covered by fixed income sources like social security, pensions, and annuities, can provide a solid foundation of financial security. Asset resources such as taxable investments and retirement accounts then complement by addressing variable expenses such as travel, large purchases, and gifting. With the availability of money market and high yield savings accounts offering returns of 5% or more, retirees can set aside several months of distributions in a readily accessible, high-yield option. This fund can be replenished as the market conditions improve, prompting for a continuous stream of income.

Once retirees reach the age for RMD, they are required to withdraw a portion of their IRA assets each year, which then adds to their regular income. After the RMD is satisfied, you can begin making distributions from taxable accounts to manage your tax bracket through tax loss harvesting. Tax-free assets such as Roth IRAs can be used strategically to meet cash needs while staying below the next tax bracket, but are typically the last bucket used in distribution planning due to the tax-free growth and tax-free distributions.