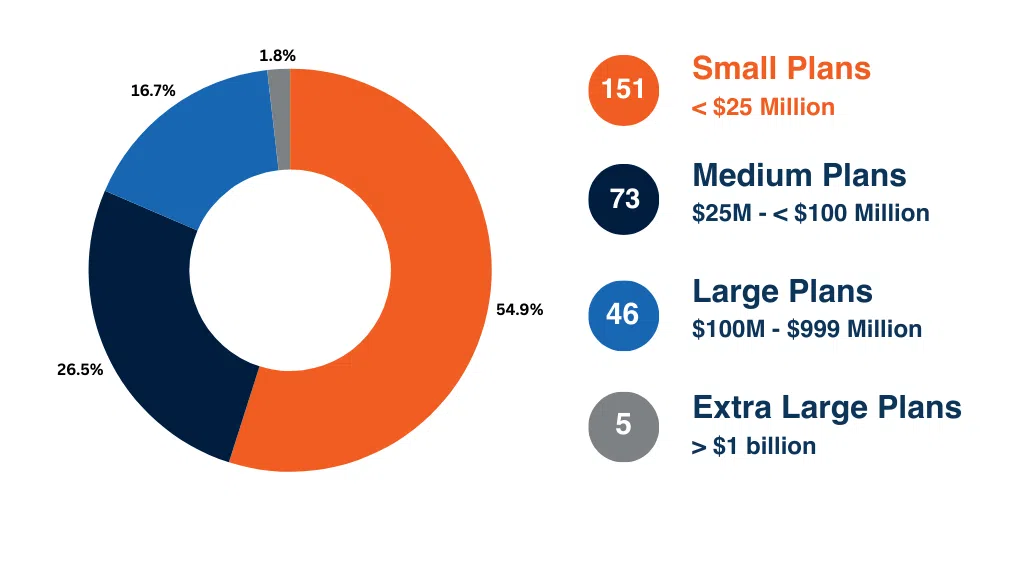

Our Employee Benefit Plan Audit team completes more than 275 audits annually and supports extensive Form 5500 filings. We handle all types of Employee Benefit Plan Audits, including those with alternative investments, master trusts, mergers, plan transfers, public company 11k filers, and terminating plans.

We specialize in ERISA Employee Benefit Plan Audits for plans just over the 100‑participant threshold to large plans with several thousand participants. We have a dedicated team to prepare Form 5500s and ensure compliance for plans of all sizes. We can assist with M&A due diligence, uncovering and correcting issues that could affect plan qualification or attract regulatory scrutiny. Our Employee Benefit Plan Audit practice is subject to frequent quality oversight from regulators, including a peer review required by the American Institute of Certified Public Accountants (AICPA) every three years, Public Company Accounting Oversight Board (PCAOB) inspections approximately every three years , and the U.S. Department of Labor (DOL). There have been no findings from our latest inspections; this reinforces our commitment to audit quality.

Why Choose Whitley Penn?

Why Choose Whitley Penn?

Employee Benefit Plan Audit Services

We provide several services designed to meet the specific needs of nonprofit organizations. Below are a few of the ways we can support your organization:

Audit

- 401(k), 403(b), 401(a) and profit-sharing defined contribution plans

- Employee health and welfare plans

- ESOPs

- Defined benefit pension plans

- Public sector retirement plans

- Plans requiring a form 11-K filing with the SEC

- Plans held in a master trust

- Plan mergers, spin-offs and terminations

- Due diligence guidance on employee benefit plans before and after mergers and acquisitions

- Assistance with preparation of financial statements

- Reporting compliance

- Identification and correction of plan issues

Compliance, Reporting, and Additional Services

- Prepare and file form 5500, including all applicable schedules and attachments

- Prepare and file form 5558 extensions

- Prepare and file form 8955-SSA

- Prepare summary annual reports

- Responding to any DOL or IRS correspondence that may arise

- Assisting with any IRS or DOL examination

- Preparation and filing of Delinquent Filer Voluntary Compliance Program filings

- Uncovering the appropriate plan design

- Eliminating inefficiencies and maximizing benefits

Trusted Technology Partners

By utilizing these sophisticated, secure audit tools, we significantly enhance operational efficiencies, reduce the burden of an Employee Benefit Plan Audit placed on you and your team, and dedicate more of our talent's time to analyzing the critical aspects of your financial data.

Our Employee Benefit Plan Audit Approach

Click the right arrow after hovering to see more stages of our Audit process

0+

0+

0+

Meet the Practice Leader

Meet the Practice Leader

Hover over Adam's headshot to view contact information, read his full bio, or connect on LinkedIn.

Adam Rhodes

Audit Partner

Adam Rhodes has more than 17 years of audit and assurance experience working with public and private clients in the energy, professional services, manufacturing, distribution & logistics, private equity & investment funds, real estate, construction, healthcare, and employee benefit plan industries. He is the industry leader for Whitley Penn’s Employee Benefit Plan Audit group.

Adam has significant Employee Benefit Plan Audit experience with a variety of types of plans including plans held in a master trust, 403(b) plans, defined benefit plans, plans with Form 11-Ks filing with the Securities Exchange Commission (SEC), and plans with mergers/terminations/ spinoffs. In addition, he has experience assisting clients through Department of Labor (DOL) investigations as well as fraud investigations.

AICPA Membership

We are proud members of the AICPA Employee Benefit Plan Audit Quality Center (EBPAQC).

AICPA Membership

We are proud members of the AICPA Employee Benefit Plan Audit Quality Center (EBPAQC).

Frequently asked questions

See below for answers to common EBP-related questions.

Who is required to have an employee benefit plan audit?

Generally, plans with 100 or more participants with an account balance at the beginning of the plan year are required to undergo an audit. This rule applies to plan years beginning on or after January 1, 2023, and is based on participants with a balance.

What types of employee benefit plans are subject to audit requirements?

Plans covered under ERISA, including 401(k), 403(b), defined benefit plans, Employee Stock Ownership Plans (ESOPs) and health and welfare benefit plans, may require an annual audit depending on participant count and plan characteristics.

What is the purpose of an employee benefit plan audit?

An audit provides assurance that the plan’s financial statements are accurate, evaluates compliance with the plan document and ERISA, and helps identify internal control, compliance and/or operational issues. It also supports the plan administrator in filing a complete and accurate Form 5500.

What is included in an employee benefit plan audit?

Included in an employee benefit plan audit, auditors examine plan operations with review of the plan document including but not limited to internal controls, participant data, contributions, distributions, review of payroll reports, census data, and investment information. Audits are conducted to help ensure compliance with ERISA, DOL, and IRS requirements.

How long does an employee benefit plan audit take?

Depending on plan complexity and how prepared the sponsor is with required documentation, audits may take several weeks to multiple months. Starting early and responding promptly to auditor requests shortens the timeline.

What are common issues auditors uncover during employee benefit plan audits?

Common findings often involve participant data errors, timeliness of contributions, distribution processing errors, loan repayment errors or documentation inconsistencies. These align with areas the U.S. Department of Labor has identified as frequently deficient across the industry.

How can plan sponsors prepare for an employee benefit plan audit?

Plan sponsors should gather required plan documents, review internal controls to ensure they are operating effectively, coordinate with service providers frequently, and review plan documents to ensure they are in accordance with ERISA, DOL, and IRS requirements. Early preparation can potentially improve efficiency and audit timeliness.

Why is selecting the right employee benefit plan auditor important?

A qualified auditor helps protect plan assets, ensures regulatory compliance, reduces risk of DOL findings, and supports accurate financial reporting. ERISA requires the auditor to be a licensed, independent CPA with EBP-specific experience. [dol.gov]